Park Hotels Amp Resorts Inc

17 own

11 watching

Current Price

$14.93

$0.41

(2.82%)

1 Week Returns

3 Months Returns

1 Year Returns

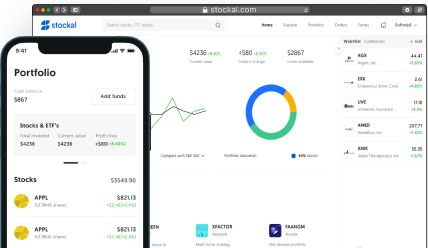

Get Started with as little as $1.00

Market Capitalization

3,574.32M

52-Week High

18.05000

52-Week Low

11.05000

Average Volume

2.28M

Dividend Yield

0.087922

P/E Ratio

2.63

Market Capitalization3,574.32M

Market Capitalization3,574.32M 52-Week High18.05000

52-Week High18.05000 52-Week Low11.05000

52-Week Low11.05000 Average Volume2.28M

Average Volume2.28M Dividend Yield0.087922

Dividend Yield0.087922 P/E Ratio2.63

P/E Ratio2.63What does the Park Hotels Amp Resorts Inc do?

Park Hotels & Resorts Inc. (“we,” “us,” “our” or the “Company”) is a Delaware corporation that owns a portfolio of premium-branded hotels and resorts primarily located in prime United States (“U.S.”) markets. On January 3, 2017, Hilton Worldwide Holdings Inc. (“Hilton” or “Parent”) completed the spin-off of a portfolio of hotels and resorts that established Park Hotels & Resorts Inc. as an independent, publicly traded company. The spin-off transaction was effected through a pro rata distribution of Park Hotels & Resorts Inc. stock to existing Hilton stockholders.

For U.S. federal income tax purposes, we intend to elect to be taxed as a real estate investment trust (“REIT”), effective for our tax year ending December 31, 2017. We are currently, and expect to continue to be, organized and operate in a REIT qualified manner. From the spin-off date, Park Intermediate Holdings LLC (our “Operating Company”), directly or indirectly, holds all of our assets and conducts all of our operations. We own 100% of the interests in our Operating Company.

Read More

How much money does Park Hotels Amp Resorts Inc make?

News & Events about Park Hotels Amp Resorts Inc.

Ticker Report

1 year ago

Park Hotels Resorts (NYSE:PK Get Rating) and Sotherly Hotels (NASDAQ:SOHOO Get Rating) are both finance companies, but which is the better investment? We will contrast the two companies based on the strength of their earnings, valuation, profitability, institutional ownership, ...

Benzinga

1 year ago

Latest Ratings for PK

DateFirmActionFromTo Jan 2022B of A SecuritiesDowngradesBuyNeutral Dec 2021Goldman SachsDowngradesNeutralSell Oct 2021Wells FargoDowngradesOverweightEqual-Weight

View More Analyst Ratings for PK

View the Latest Analyst Ratings

read more...

Globe Newswire

1 year ago

TYSONS, Va., Dec. 22, 2022 (GLOBE NEWSWIRE) -- Park Hotels & Resorts Inc. (Park or the Company) (NYSE:PK) today provided an update on fourth quarter operating trends and the Companys capital allocation activity. Recent Highlights: Hotel net income for October 2022 and November 2022 was $41 million ...

Ticker Report

1 year ago

Park Hotels Resorts Inc. (NYSE:PK Get Rating) has been given an average rating of Hold by the fourteen research firms that are presently covering the stock, Marketbeat Ratings reports. One analyst has rated the stock with a sell recommendation, seven have assigned a hold ...

Frequently Asked Questions

Frequently Asked Questions

What is Park Hotels Amp Resorts Inc share price today?

Can Indians buy Park Hotels Amp Resorts Inc shares?

How can I buy Park Hotels Amp Resorts Inc shares from India?

Can Fractional shares of Park Hotels Amp Resorts Inc be purchased?

What are the documents required to start investing in Park Hotels Amp Resorts Inc stocks?

What is today’s traded volume of Park Hotels Amp Resorts Inc?

What is today’s market capitalisation of Park Hotels Amp Resorts Inc?

What is the 52-Week High and Low Range of Park Hotels Amp Resorts Inc?

What percentage is Park Hotels Amp Resorts Inc down from its 52-Week High?

What percentage is Park Hotels Amp Resorts Inc up from its 52-Week Low?

Current Price

$14.93

$0.41

(2.82%)

1 Week Returns

3 Months Returns

1 Year Returns

Get Started with as little as $1.00