Liberty Oilfield Services A

5 own

8 watching

Current Price

$22.97

$0.69

(3.1%)

1 Week Returns

3 Months Returns

1 Year Returns

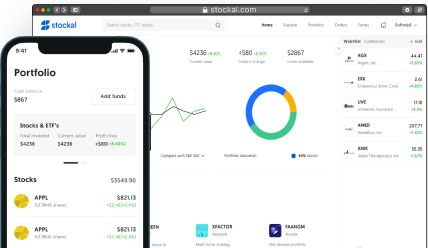

Get Started with as little as $1.00

Market Capitalization

2,386.53M

52-Week High

24.75000

52-Week Low

15.57000

Average Volume

2.13M

Dividend Yield

--

P/E Ratio

--

Market Capitalization2,386.53M

Market Capitalization2,386.53M 52-Week High24.75000

52-Week High24.75000 52-Week Low15.57000

52-Week Low15.57000 Average Volume2.13M

Average Volume2.13M Dividend Yield--

Dividend Yield-- P/E Ratio--

P/E Ratio--What does the Liberty Oilfield Services A do?

Liberty Energy Inc. provides hydraulic fracturing and wireline services, and related goods to onshore oil and natural gas exploration and production companies in North America. It also offers hydraulic fracturing pressure pumping services, including pressure pumping and pumpdown perforating services, as well wireline services, proppant delivery solutions, data analytics, related goods and technologies. In addition, the company owns operates two sand mines in the Permian Basin. As of December 31, 2021, it had a total of approximately 30 active frac fleets. The company offers its services primarily in the Permian Basin, the Eagle Ford Shale, the Denver-Julesburg Basin, the Williston Basin, and the Powder River Basin. The company was formerly known as Liberty Oilfield Services Inc. and changed its name to Liberty Energy Inc. in April 2022. Liberty Energy Inc. was founded in 2011 and is headquartered in Denver, Colorado.

Read More

How much money does Liberty Oilfield Services A make?

News & Events about Liberty Oilfield Services A.

Business Wire

1 year ago

Liberty announced today the commercial launch of Liberty Power Innovations (LPI), an integrated alternative fuel and power solutions provider for remote applications. LPIs initial focus is on compressed natural gas (CNG) supply, field gas processing and treating, and well site fueling and...

Zolmax

1 year ago

Shares of Liberty Energy Inc. (NYSE:LBRT Get Rating) have received an average recommendation of Moderate Buy from the thirteen research firms that are presently covering the firm, Marketbeat reports. Two research analysts have rated the stock with a hold rating and six have issued a buy rating on ...

Ticker Report

1 year ago

Shares of Liberty Energy Inc. (NYSE:LBRT Get Rating) have received an average recommendation of Moderate Buy from the thirteen research firms that are presently covering the firm, Marketbeat reports. Two research analysts have rated the stock with a hold rating and six have ...

Ticker Report

1 year ago

Shares of Liberty Energy Inc. (NYSE:LBRT Get Rating) have earned an average recommendation of Moderate Buy from the thirteen ratings firms that are covering the stock, Marketbeat reports. Two investment analysts have rated the stock with a hold recommendation and six have ...

Business Wire

1 year ago

Liberty Energy Inc. (NYSE: LBRT; Liberty or the Company) announced today fourth quarter and full year 2022 financial and operational results. Summary Results and Highlights Revenue of $4.1 billion, a 68% increase over the prior year, and net income1 of $400 million, or $2.11 fully diluted earnings...

Frequently Asked Questions

Frequently Asked Questions

What is Liberty Oilfield Services A share price today?

Can Indians buy Liberty Oilfield Services A shares?

How can I buy Liberty Oilfield Services A shares from India?

Can Fractional shares of Liberty Oilfield Services A be purchased?

What are the documents required to start investing in Liberty Oilfield Services A stocks?

What is today’s traded volume of Liberty Oilfield Services A?

What is today’s market capitalisation of Liberty Oilfield Services A?

What is the 52-Week High and Low Range of Liberty Oilfield Services A?

What percentage is Liberty Oilfield Services A down from its 52-Week High?

What percentage is Liberty Oilfield Services A up from its 52-Week Low?

Current Price

$22.97

$0.69

(3.1%)

1 Week Returns

3 Months Returns

1 Year Returns

Get Started with as little as $1.00