Independent Bank Corp

4 own

5 watching

Current Price

$64.07

$1.07

(1.7%)

1 Week Returns

3 Months Returns

1 Year Returns

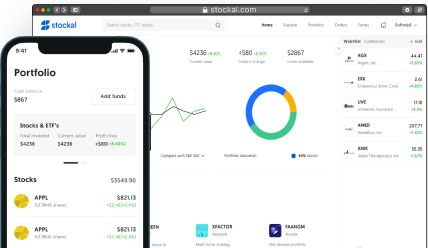

Get Started with as little as $1.00

Market Capitalization

2,276.33M

52-Week High

68.75000

52-Week Low

44.63000

Average Volume

0.2M

Dividend Yield

0.020978

P/E Ratio

19.4514

Market Capitalization2,276.33M

Market Capitalization2,276.33M 52-Week High68.75000

52-Week High68.75000 52-Week Low44.63000

52-Week Low44.63000 Average Volume0.2M

Average Volume0.2M Dividend Yield0.020978

Dividend Yield0.020978 P/E Ratio19.4514

P/E Ratio19.4514What does the Independent Bank Corp do?

Independent Bank Corp. operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses primarily in Massachusetts. The company's products and services include demand deposits and time certificates of deposit, as well as checking, money market, and savings accounts. Its loan portfolio includes commercial loans, such as commercial and industrial, asset-based, commercial real estate, commercial construction, and small business loans; consumer real estate loans, including residential mortgages, home equity loans, and loans for the construction of residential properties; and other consumer loans, such as personal loans. The company's commercial and industrial loans cover loans for working capital, other business-related purposes, and floor plan financing; asset-based loans consist primarily of revolving lines of credit and term loans; commercial real estate loans include commercial mortgages for construction purposes that are secured by nonresidential properties, multifamily properties, or one-to-four family rental properties; and small business loans comprise real estate loans and loans to businesses with commercial credit needs. It also provides investment management and trust services to individuals, institutions, small businesses, and charitable institutions; Internet and mobile banking services; and insurance services. The company operates through 80 full service and 3 limited service retail branches, 11 commercial banking centers, 5 investment management offices, and 1 mortgage lending center in Eastern Massachusetts; and an investment management group/commercial lending office in Rhode Island. Independent Bank Corp. was founded in 1907 and is headquartered in Rockland, Massachusetts.

Read More

How much money does Independent Bank Corp make?

News & Events about Independent Bank Corp.

Benzinga

1 year ago

read more...

Ticker Report

1 year ago

Independent Bank (NASDAQ:INDB Get Rating) had its price objective decreased by Piper Sandler from $83.00 to $72.00 in a research report sent to investors on Tuesday , The Fly reports. INDB has been the topic of several other reports. StockNews.com downgraded Independent Bank from a hold ...

Benzinga

1 year ago

read more...

Frequently Asked Questions

Frequently Asked Questions

What is Independent Bank Corp share price today?

Can Indians buy Independent Bank Corp shares?

How can I buy Independent Bank Corp shares from India?

Can Fractional shares of Independent Bank Corp be purchased?

What are the documents required to start investing in Independent Bank Corp stocks?

What is today’s traded volume of Independent Bank Corp?

What is today’s market capitalisation of Independent Bank Corp?

What is the 52-Week High and Low Range of Independent Bank Corp?

What percentage is Independent Bank Corp down from its 52-Week High?

What percentage is Independent Bank Corp up from its 52-Week Low?

Current Price

$64.07

$1.07

(1.7%)

1 Week Returns

3 Months Returns

1 Year Returns

Get Started with as little as $1.00