Acnb Corp

1 own

2 watching

Current Price

$39.08

$0.28

(0.72%)

1 Week Returns

3 Months Returns

1 Year Returns

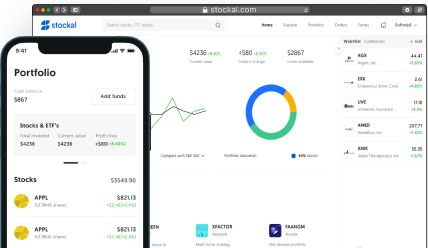

Get Started with as little as $1.00

Market Capitalization

313.85M

52-Week High

48.55000

52-Week Low

30.24000

Average Volume

0.02M

Dividend Yield

0.035651

P/E Ratio

8.0261

Market Capitalization313.85M

Market Capitalization313.85M 52-Week High48.55000

52-Week High48.55000 52-Week Low30.24000

52-Week Low30.24000 Average Volume0.02M

Average Volume0.02M Dividend Yield0.035651

Dividend Yield0.035651 P/E Ratio8.0261

P/E Ratio8.0261What does the Acnb Corp do?

ACNB Corporation, a financial holding company, provides banking, insurance, and financial services to individual, business, and government customers in the United States. The company offers checking, savings, and money market deposit accounts, as well as time deposits and debit cards. It also provides commercial lending products, such as commercial mortgages, real estate development and construction loans, accounts receivable and inventory financing, and agricultural and governmental loans; consumer lending products, including home equity loans and lines of credit, automobile and recreational vehicle loans, manufactured housing loans, and personal lines of credit; and mortgage lending programs include personal residential mortgages, and residential construction and investment mortgage loans. In addition, the company provides other services that are related to testamentary trusts, life insurance trusts, charitable remainder trusts, guardianships, powers of attorney, custodial accounts, and investment management and advisory accounts; and retail brokerage services. Further, it acts as a trustee to invest in, protect, manage, and distribute financial assets. Additionally, the company offers property and casualty, health, life, and disability insurance products to commercial and individual clients; and online, telephone, and mobile banking, as well as automated teller machine services. As of December 31, 2021, it operated through a network of 19 community banking offices located in Pennsylvania, including 12 offices in Adams county, five offices in York county, one office in Cumberland County, and one office in Franklin County; five community banking offices located in Frederick County; six community banking offices located in Carroll county, Maryland; and loan offices located in Lancaster and York, Pennsylvania, and Hunt Valley, Maryland. The company was founded in 1857 and is headquartered in Gettysburg, Pennsylvania.

Read More

How much money does Acnb Corp make?

News & Events about Acnb Corp.

Globe Newswire

1 year ago

GETTYSBURG, Pa., April 27, 2023 (GLOBE NEWSWIRE) -- ACNB Corporation (NASDAQ: ACNB), financial holding company for ACNB Bank and ACNB Insurance Services, Inc., announced financial results for the three months ended March31, 2023 with net income of $9.0 million, an increase of $2.4 million or 36.73...

Globe Newswire

1 year ago

GETTYSBURG, Pa., April 20, 2023 (GLOBE NEWSWIRE) -- ACNB Corporation (NASDAQ: ACNB), financial holding company for ACNB Bank and ACNB Insurance Services, Inc., announced today that the Board of Directors approved and declared a regular quarterly cash dividend of $0.28 per share of ACNB Corporation ...

Ticker Report

1 year ago

ACNB Co. (NASDAQ:ACNB Get Rating) saw a large growth in short interest in the month of March. As of March 15th, there was short interest totalling 72,700 shares, a growth of 7.4% from the February 28th total of 67,700 shares. Approximately 0.9% of the shares of the company are short sold. ...

Ticker Report

1 year ago

ACNB Co. (NASDAQ:ACNB Get Rating) was the target of a large decline in short interest in January. As of January 15th, there was short interest totalling 74,600 shares, a decline of 11.1% from the December 31st total of 83,900 shares. Based on an average trading volume of 12,000 shares, the ...

Globe Newswire

1 year ago

GETTYSBURG, Pa., Jan. 30, 2023 (GLOBE NEWSWIRE) -- ACNB Corporation (NASDAQ: ACNB), financial holding company for ACNB Bank and ACNB Insurance Services, Inc., announced today that the Board of Directors approved and declared a regular quarterly cash dividend of $0.28 per share of ACNB Corporation ...

Frequently Asked Questions

Frequently Asked Questions

What is Acnb Corp share price today?

Can Indians buy Acnb Corp shares?

How can I buy Acnb Corp shares from India?

Can Fractional shares of Acnb Corp be purchased?

What are the documents required to start investing in Acnb Corp stocks?

What is today’s traded volume of Acnb Corp?

What is today’s market capitalisation of Acnb Corp?

What is the 52-Week High and Low Range of Acnb Corp?

What percentage is Acnb Corp down from its 52-Week High?

What percentage is Acnb Corp up from its 52-Week Low?

Current Price

$39.08

$0.28

(0.72%)

1 Week Returns

3 Months Returns

1 Year Returns

Get Started with as little as $1.00